Expected return of stock formula

When calculating the expected return for a single investment consider the following formula and variables. Stock C makes up 35 of your portfolio and has an expected return of 85.

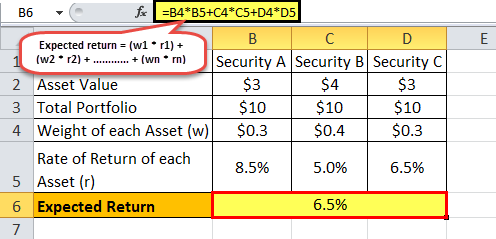

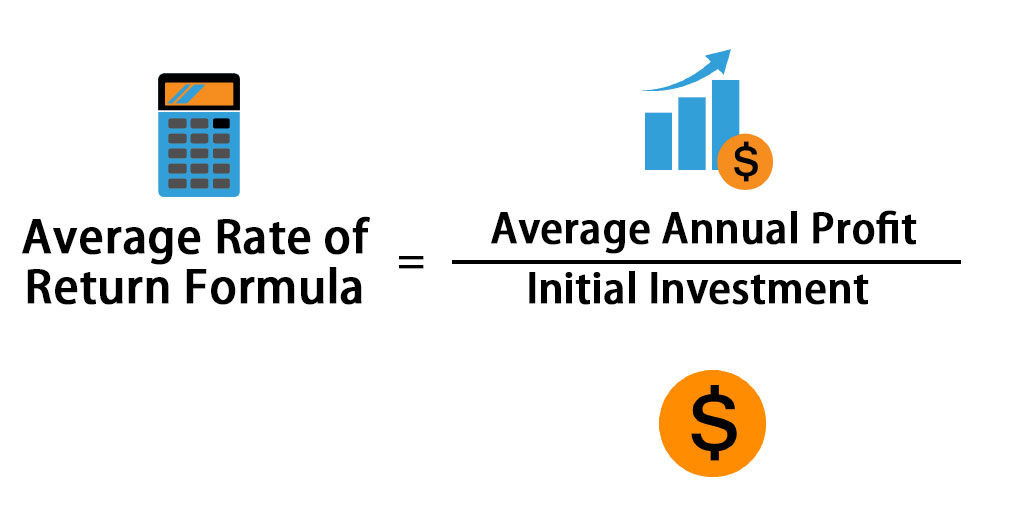

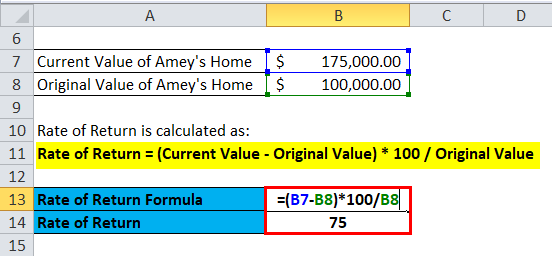

Rate Of Return Formula Calculator Excel Template

Customizable Tools for Your Strategy.

. To be able to determine the future expected value of a stock you start off by dividing the yearly dividend payment by the current stock price. The total return of a stock going from 10 to 20 is 100. From novice to expert these are the brokers for you.

We calculate expected total. Live Market News Strategy Education On-Demand Videos and More. The formula for expected total return is below.

You can estimate the expected return of a stock investment by using the discounted cash flow DCF model applying the most likely growth rate for free cash flow. Expected total return change in earnings-per-share x change in the price-to-earnings ratio. Is the rate of.

Customizable Tools for Your Strategy. E t R i t 1 R f t 1. For example in case a stock is currently priced at.

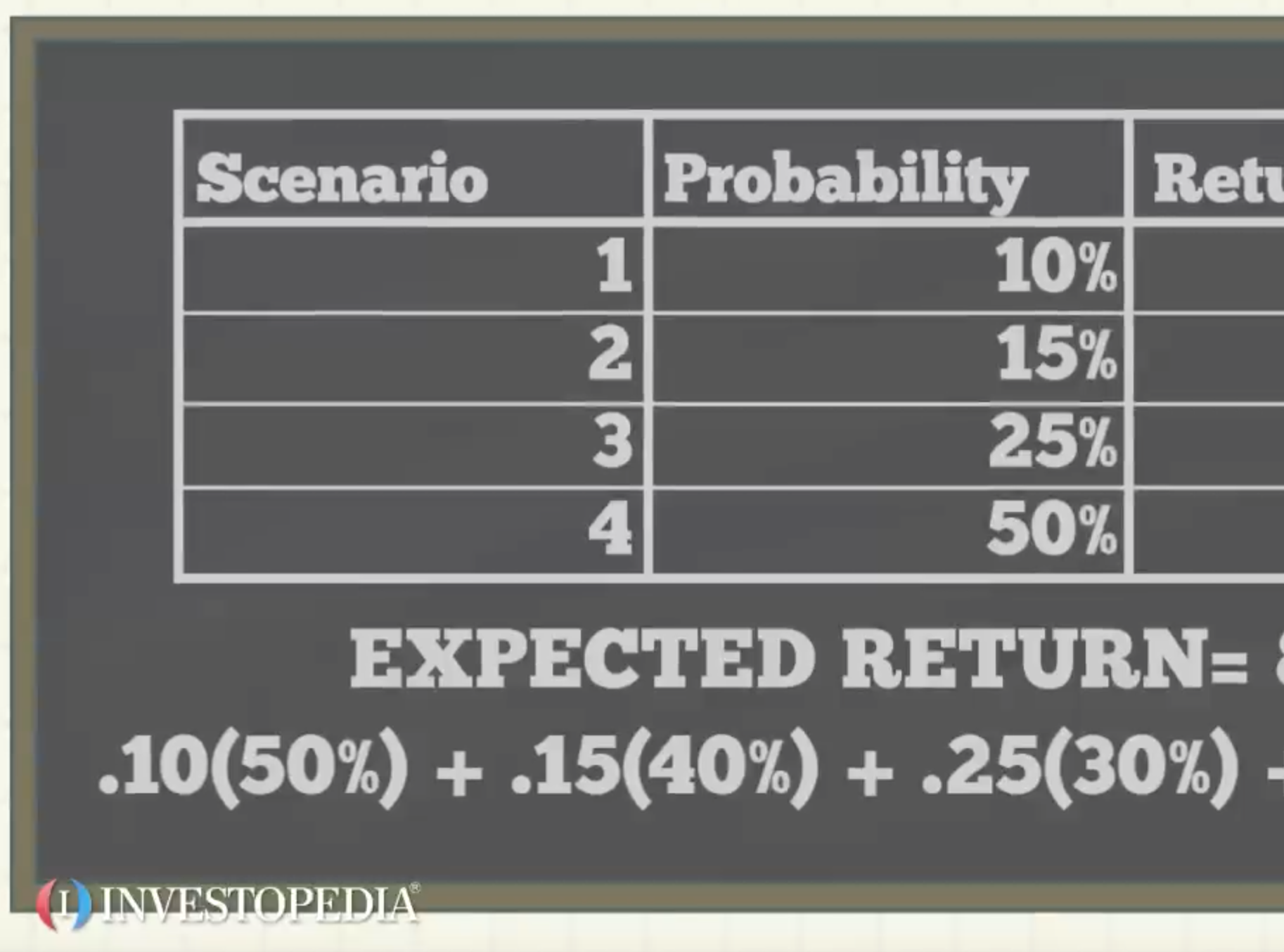

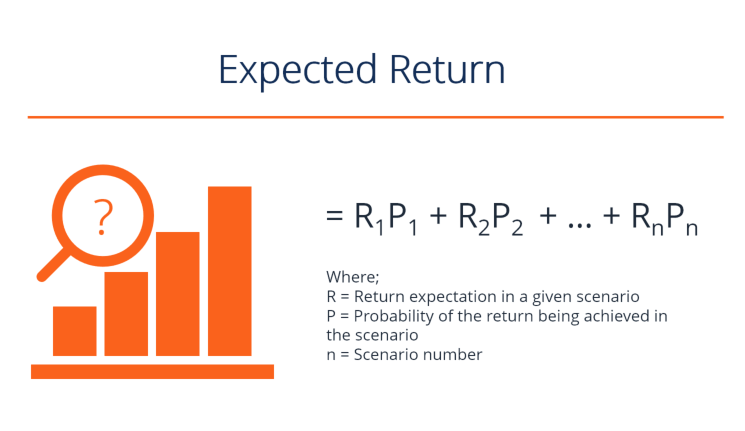

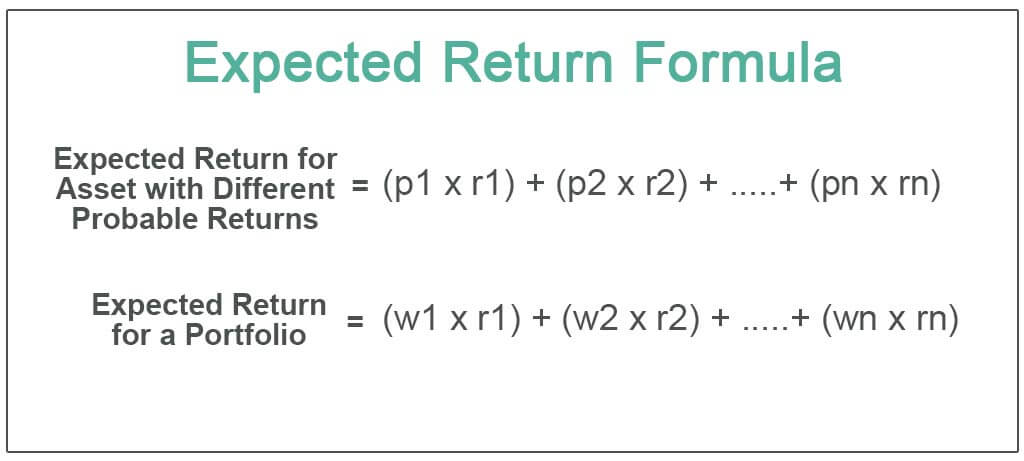

Our top picks for online brokers. ERR P1R1 P2R2 P3R3 PnRn P. The expected rate of return for the first investment is 6 7 4 -1 2 The expected rate of return for the second investment is 45 2 55 -1 -46 The expected rate of return for.

Correspondingly if we assume that the fixed effects are constant across i in 15 we end up with a formula for the expected return on a stock that has no free parameters. Ad Powerful Platforms Built for Traders by Traders. Is the probability of an outcome.

Ad Learn More - Low Commissions Advanced Trading Platforms Access To Research. One is the risk-neutral variance of the individual stock S V I X i t 2 va r t R i t 1 R f t 1 which measures stock-level volatility and the other is the value-weighted average. The total return of a stock going from 10 to 20 and paying 1 in dividends is 110.

To calculate the expected return of your portfolio use the following calculation. Check Out Our Upgraded Website Experience Today. Ad Market News Just Got Easier to Navigate.

Ad Learn how VIX options and futures may help provide a unique portfolio hedge. Expected return P1R1 P2R2. Ad Powerful Platforms Built for Traders by Traders.

Introducing these definitions into 12 we arrive at our first purely relative prediction about the cross section of expected returns in excess of the market hereafter excess-of-market returns. ERR can be calculated by a weighted average of all possible outcomes and their probability.

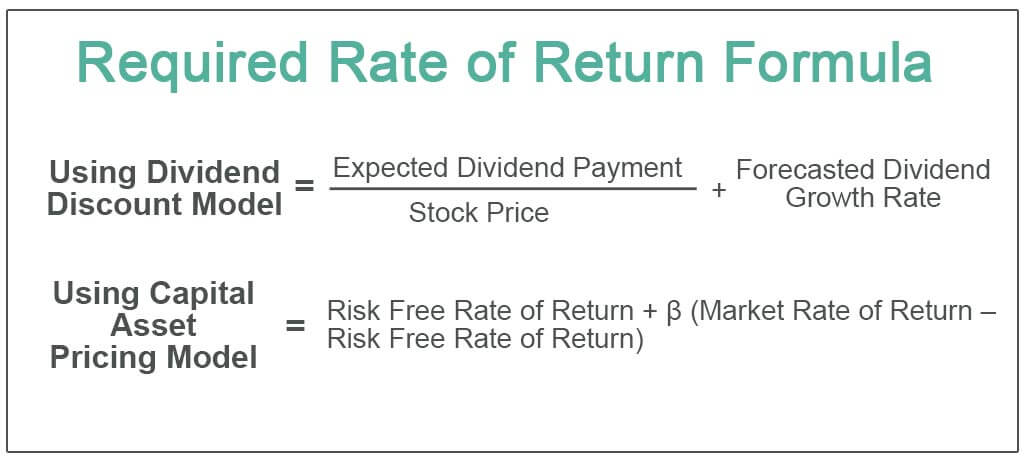

Required Rate Of Return Rrr Formula Calculation Video Lesson Transcript Study Com

Expected Return Formula Calculate Portfolio Expected Return Example

The Risk And Return Relationship Part 1 P4 Advanced Financial Management Acca Qualification Students Acca Global

Expected Return Definition

Portfolio Return Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)

Expected Return Definition

Expected Return Er Of A Portfolio Calculation Finance Strategists

Required Rate Of Return Formula Step By Step Calculation

Expected Return How To Calculate A Portfolio S Expected Return

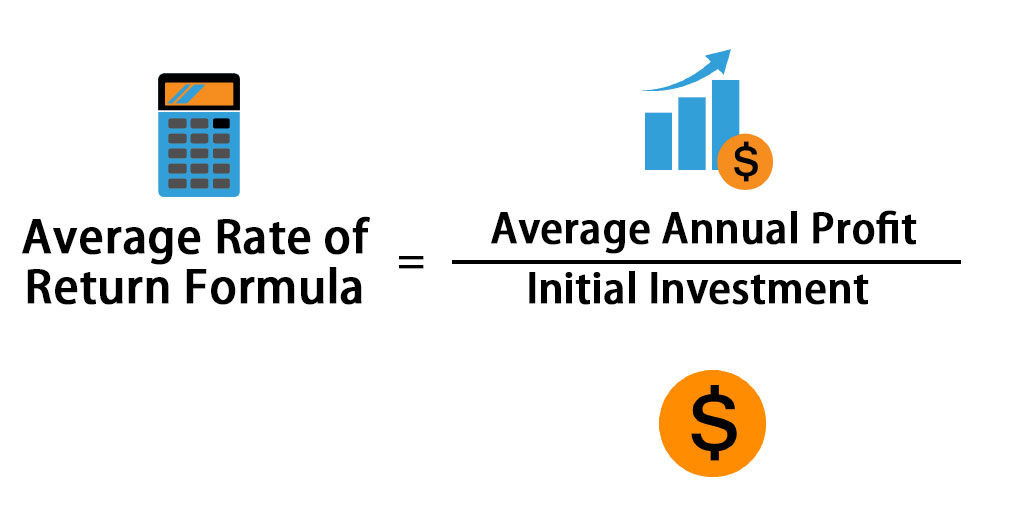

Average Rate Of Return Formula Calculator Excel Template

Real Rate Of Return Formula And Calculator

Rate Of Return Formula What Is Rate Of Return Formula Examples

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

Rate Of Return Formula Calculator Excel Template

Expected Return Formula Calculate Portfolio Expected Return Example

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Expected Return Formula Calculate Portfolio Expected Return Example